- STATES REVOKING LICENSES OVER STUDENT LOAN DEFAULTS LICENSE

- STATES REVOKING LICENSES OVER STUDENT LOAN DEFAULTS PROFESSIONAL

STATES REVOKING LICENSES OVER STUDENT LOAN DEFAULTS LICENSE

It estimates the actual number of health care license suspensions is between 90 and 120 since November 2016. The board clarified it worked out repayment plans with most of those workers. To see more, visit Montana Public Radio.CLARIFICATION: The state Board of health says about nine hundred healthcare workers were in danger of losing their license over the past two years because they were in default of their student loans. An attempt to repeal a similar law there failed earlier this year.Ĭopyright 2020 Montana Public Radio. The Montana bill to take away license revocation as a consequence for student loan default passed with bipartisan support. "Removing my driver's license," she adds, "you just created one more barrier for me being a productive citizen in my community."

There are plenty of sticks already, like having your wages garnisheed and your credit ruined, says Lindley. And what a better way than their driver's license?" "I think that this is one of the sticks that we can use over a kid who is not paying their student loans," she says. "Then it's a way for a state to identify that person and really help them get into repayment."īut some policymakers want to retain consequences for defaulting. "The state loan authorities would report anybody who had defaulted on loans to all the licensing entities around the state," he says. Weeden adds that tying student loans to licenses, which often have to be renewed every couple of years, created a process to find people when they defaulted. "Because states were essentially the direct lenders to students, many states had large loan portfolios," he says.

STATES REVOKING LICENSES OVER STUDENT LOAN DEFAULTS PROFESSIONAL

So Funk wrote a bill ending the state's right to revoke professional or driver's licenses because of student loan defaults.ĭustin Weeden, a policy analyst at the National Conference of State Legislatures, says a lot of states passed license revocation laws for student loan defaulters in the 1990s and early 2000s, back before the federal government started taking on a bigger role in lending to students. "There isn't public transportation, or very little," Funk says. If the goal is to get people to make loan payments, taking away their ability to drive to work just makes it harder for them to make money, especially in rural states. Not to mention, she says, counterproductive.

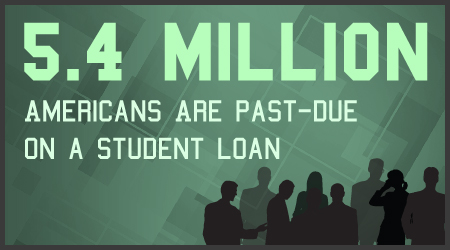

Moffie Funk learned that that was a potential consequence, she says she felt embarrassed. That's putting a lot of people's livelihoods at risk.īut Montana, where Lindley lives, is rolling those sanctions back. The percentage of Americans defaulting on their student loans has more than doubled since 2003. In 22 states, defaulters can have the professional licenses they need to do their jobs suspended or revoked if they fall behind in their student loan payments, licenses for things like nursing or engineering.

But had she defaulted longer, the state of Montana could have revoked her driver's license.

That was motivation enough for Lindley to figure out ways to make her payments. "There was a time where I defaulted on my student loans enough that I never was sent to collections, but just long enough to, honestly, ruin my credit." "Removing my driver's license, you just created one more barrier for me being a productive citizen in my community."įresh out of school, Lindley says there were times when she had to decide whether to pay rent, buy food or make her student loan payments.

0 kommentar(er)

0 kommentar(er)